Renters Insurance in and around El Paso

Renters of El Paso, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented house is home. Since that is where you kick your feet up and make memories, it can be a good idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your sports equipment, towels, boots, etc., choosing the right coverage can help protect your belongings.

Renters of El Paso, State Farm can cover you

Renters insurance can help protect your belongings

Why Renters In El Paso Choose State Farm

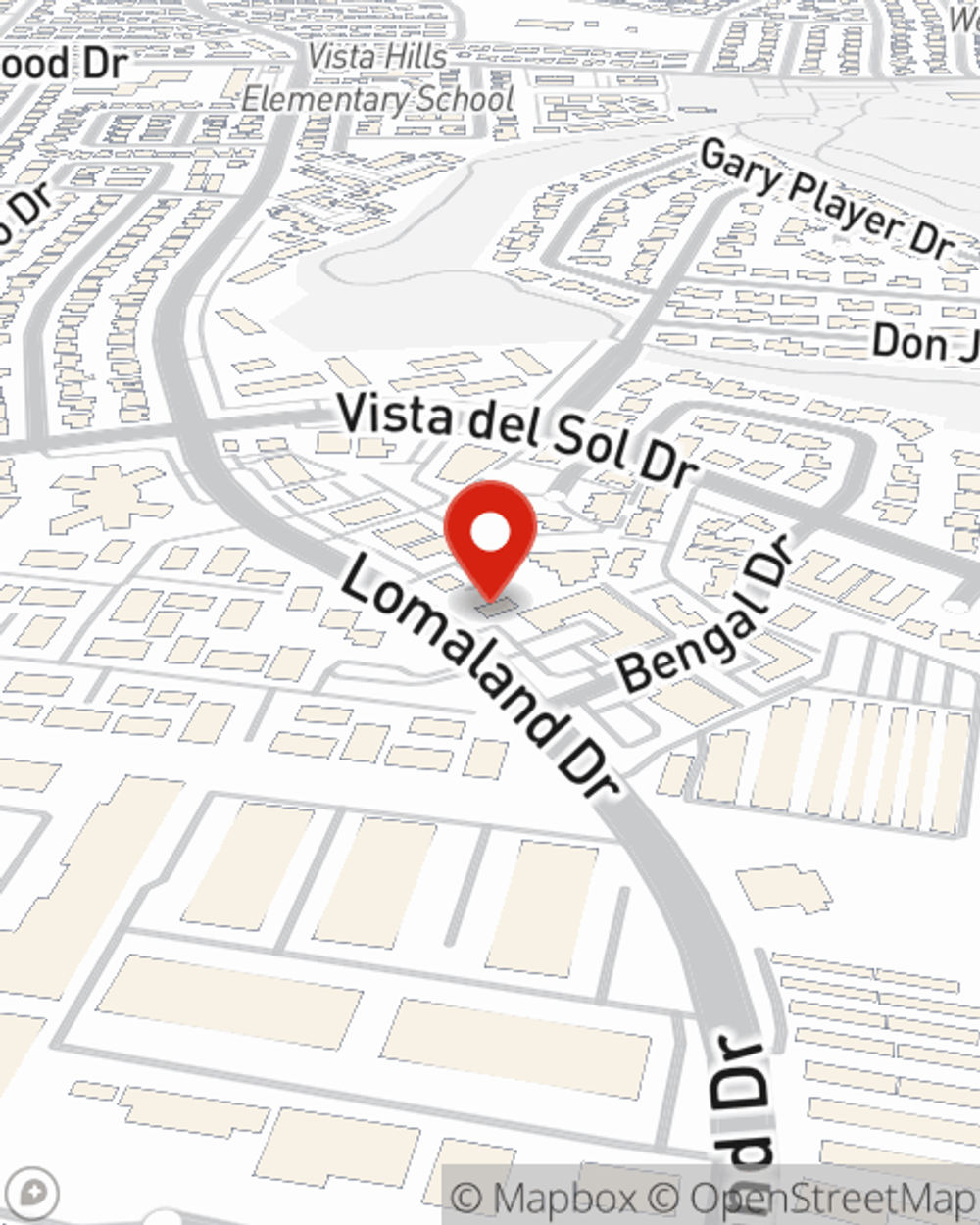

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented apartment include a wide variety of things like your favorite blanket, smartphone, couch, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Eric Fierro has the experience and dedication needed to help you evaluate your risks and help you keep your things safe.

Get in touch with Eric Fierro's office to learn more about how you can benefit from State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Eric at (915) 595-3622 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Eric Fierro

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.